Electronic signatures are at the core of organizations providing secure foundations that protect data, processes, systems and users in the modern digital world. Electronic document signing has become commonplace for businesses and government agencies to carry out secure transactions, safe customer and citizen journeys and seamlessly authenticate identities.

Effective e-signature and e-sign digital signature solutions enable organizations to future-proof their interactions and protect themselves against sophisticated modern cyber risks. Below, we’ll explore what is electronic signature and the benefits and legalities surrounding the use of e signature solutions.

What is an Electronic Signature?

An electronic signature, commonly referred to as an eSignature or e-signature, is an online method for signing a digital document. It replaces the traditional way of physically signing a document, enabling signers to attach their signature, name and initials electronically.

If you’re questioning what is an e signature, the process uses digital impressions and markups to signify the person signing a document agrees to the terms of the agreement or contract. As a result, this e signature meaning enables users to easily and confidently certify legal documents and bind themselves to the terms of a document without having to be in the same room as the document creator.

The Importance of Using Electronic Signatures?

Handwritten signatures have been relied on to authorize contractual agreements and legal processes for hundreds of years. However, in the modern digital world, with organizations doing business in different cities and countries, it’s not always easy for two people to sign the same document in person.

Organizations increasingly rely on electronic transactions, especially with the rise of e-commerce, online business models and remote work practices. As a result, customers, governments and online retailers need a simple process to certify documents and prove intent at any time and from anywhere.

Electronic signatures empower businesses and individuals to efficiently, legally and securely sign documents online. This process ensures people can close deals, sign contract agreements and agree on terms without meeting face to face. Instead, they can sign documents remotely on any device and from anywhere.

Electronic document signing enables organizations to securely conduct online transactions and prevent cyber risks like data theft, forgery and fraud. Handwritten signatures have traditionally been protected by witnesses who could testify to the signees’ authenticity. However, e-signatures use more sophisticated approaches to guarantee authenticity and verify identity.

How are Electronic Signatures Different from Digital Signatures?

An e-signature describes the technology used to authenticate, certify and sign digital documents. Whereas a digital signature is a form of e-signature that provides businesses with a high level of trust.

Digital signatures rely on public key infrastructure (PKI), a credential system that issues cryptographic assets known as digital certificates, to verify electronic transactions. Digital certificates are unique to each signer, guaranteeing organizations that only the specific individual could have authorized a transaction.

Digital signatures use another cryptographic asset, the document signing certificate. When a signee electronically signs a document, the certificate and a timestamp are embedded into the signature. Digital signatures are also calculated based on the document’s contents, and any changes will break the signature, which helps businesses prevent repudiation and tampering.

As a result, digital signatures prevent signers from claiming their signature has been used without their knowledge. They also provide organizations the confidence to do business online without compromising security and trust.

3 Key Types of Electronic Signatures

Three core types of electronic signatures are signified by the level of assurance they offer organizations. These three types of e-signature provide a level of assurance and reliability to help signees guarantee consent, identity and intent:

1. Low assurance e-signatures: Any electronically-created signature can be considered an e-signature. The type of eSignature with the lowest form of assurance is drawn with a mouse, scanned into a digital document or typed into a PDF. These basic electronic signatures are more likely to be vulnerable to fraud and can be easily disputed.

2. High assurance e-signatures: Electronic signatures are highly reliable as they utilize PKI and digital certificates. This added security makes the digital signatures more difficult to alter, counterfeit, tamper or dispute.

3. Regulated high assurance e-signatures: Digital signatures that have been legally regulated offer the highest possible level of assurance. These e-signatures are protected by PKI and document signing certificates, but are also compliant with legal standards. The signing infrastructure is usually maintained by trust service providers, which are subject to auditing and regulation.

Choosing The Right Electronic Signature For Your Needs

Selecting the correct electronic signature depends on the specific organization’s needs. Some applications, legal documents and transactions, such as signing a mortgage, are especially sensitive and require greater confidence in the signer’s consent, identity and intent. Additionally, organizations can adjust the proof level for specific circumstances.

Selecting the right signature type may also depend on the purpose it’s being used for, including:

- Industry requirements, such as anti-money laundering laws and know-your-customer procedures.

- Cross-border regulations like the European Union’s electronic identification and trust services (eIDAS).

- National or state legislation, such as the United States’ e-Sign Act.

6 Practical Uses of Electronic Signatures

Electronic signatures are increasingly relied on to secure documents across various industries and critical services. Examples of how companies commonly use e-signatures include:

1. E-Signatures in Financial Services

Electronic signatures are crucial to financial services capturing and sharing information securely with customers and partners. Using e-signatures enables organizations to meet the seamless, paperless experiences that their customers demand.

2. E-Signatures in Healthcare

Healthcare organizations can enhance efficiency and protect patient privacy using electronic signatures. Building e-signatures into workflows helps organizations automate their processes and allows patients and healthcare professionals to sign documents remotely at any time and on any device.

3. E-Signatures in Human Resources

Human resources staff can streamline their processes by using electronic signatures. E-signatures enable employees and prospective job candidates to access and sign documents remotely anytime and anywhere.

4. E-Signatures in Government

Approved e-signature solutions are authorized by governmental systems like the compliance program Federal Risk and Authorization Management Program (FedRAMP), which standardizes assessment, authorization and monitoring for cloud services. Utilizing e-signatures in government agencies enables them to simplify their processes and ensure data is shared securely with citizens and employees.

5. E-Signatures in Information Technology

Tech firms can use electronic signatures to create digital workflows across their organizations. Utilizing e-signatures enables companies to develop automated e-sign and approval workflows for all their departments and teams, removing the need for manual processes.

6. E-Signatures in Sales

Sales organizations use electronic signatures to keep their teams focused on the tasks at hand. The process also prevents salespeople from continually carrying out manual and repetitive administrative tasks, such as signing every contract by hand.

4 Major Benefits of Using Electronic Signatures

Electronic signatures offer various benefits for organizations in multiple industries, from remote document signing to online security. The biggest benefits of building e-signatures into corporate processes include:

1. Sign Contracts from Anywhere

E sign digital signature capabilities enable signatories to sign contracts or legal agreements anytime and anywhere. This ensures people worldwide can sign an agreement remotely and collaborate on the same document wherever they are. E-signatures enable people to sign documents via email, mobile apps or web browsers, making it quicker and easier to get contracts signed by all required parties.

2. Bulk Document Signing

E-signature solutions also help organizations simplify bulk signing, enabling people in various locations worldwide to sign the same document simultaneously. This capability is crucial for large organizations with multiple departments and large teams of people in disparate offices to collaborate on documents and sign agreements at any time. Employees can send contracts and legal agreements to numerous contracts and rapidly receive responses in seconds, rather than waiting days or weeks to see them in person or share contracts via fax machine.

3. Enhanced Security

Electronic signatures provide an extra layer of security compared to traditional handwritten signatures. The old way of signing contracts could technically be confirmed using witnesses to countersign a document. But there was no record of the signatures beyond that, and both signatures could be faked.

Conversely, confirming a legal agreement or contract via an electronic signature solution provides an indisputable fact that only the intended individual could have signed the document. The e-signature solution captures critical data like the signing person’s identity, IP address, the device they used and the date and time they signed the document. The solution also tracks when all parties viewed the contract and the different versions of the document throughout its lifecycle.

4. Legally Binding Documents

A key advantage of using electronic signatures is their legally binding status with regulators across multiple industries. For example, signing a document electronically has been considered lawfully binding by regulations like the UK’s Electronic Communication Act, the European Union’s eIDAS and the United States’ ESIGN Act, which confirms legal validity in all 50 US states where federal law applies.

How to Create Secure and Legal E-Signatures?

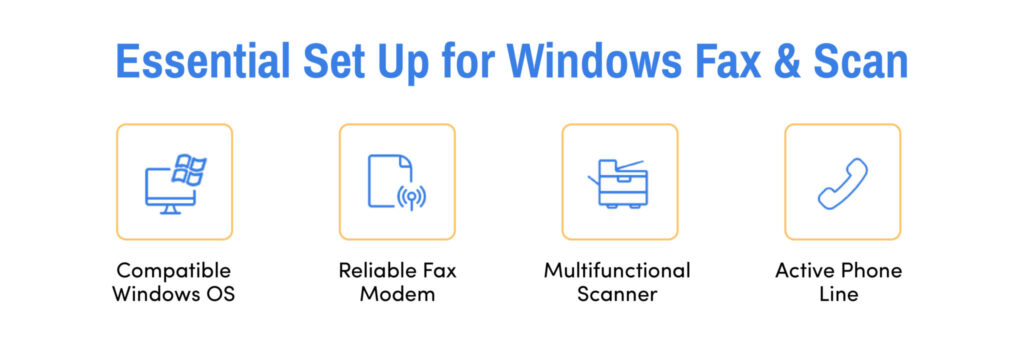

The best way to create a secure and legally binding e-signature is to use an authorized electronic document signing solution. Specialist eSignature software is designed to finalize contracts and legal agreements with secure e-signatures.

These solutions offer rich feature sets that allow organizations to sign contracts in bulk, enable customizable signing options and provide more stringent authorization and validation measures.

However, organizations sign contracts differently and rely on various methods to create e-signatures. A few options for creating e-signatures include:

Draw A Signature: Users can create an electronic signature on a touchscreen mobile device like a smartphone or tablet. They simply draw their signature directly on the phone or tablet using their finger.

Write A Signature: Users with a digital signing pad can use a stylus pen to draw their eSignature. This is a good option for people who want to reflect their handwritten signatures on paper documents.

Select A Template: Electronic signature solutions provide templates that allow users to quickly create a custom eSignature. Users select a template style they like and then type their name to automatically generate a signature.

Upload A Signature: Users can also use their handwritten signature to create an electronic version. Users take a photo of their physical signature on their mobile phone and then upload the image to their electronic signature solution. With the signature saved, they can easily use it on future documents.

Legal Aspects and Compliance for Electronic Signatures

Electronic signatures can be crucial for organizations to comply with legal restrictions and industry regulations. Nations worldwide have fluctuating legislation surrounding e-signatures, so it’s vital for businesses to fully understand the specific rules and regulations of the countries and regions in which they operate.

In the United States, the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) detail four requirements for an e-signature to be valid under US law. The ESIGN Act, introduced in 2000, enables electronic signatures in the 50 US states where federal law applies. The act defines an e-signature as an electronic process, sound or symbol attached to or associated with a document executed by an individual who intended to sign the document.

The four requirements set out by ESIGN and UETA are:

- Intent to sign: The acts outline that e-signatures, like traditional signatures, are only valid if every party intended to sign the document.

- Consent to do business electronically: The acts detail that all parties must consent to do business electronically by analyzing the circumstances around the interaction. Consumers may require special consideration, and electronic records can only be used in transactions if they’ve received UETA Consumer Consent Disclosures, agreed to use electronic records and haven’t withdrawn their consent.

- Signature association with the record: To qualify as an e-signature under the ESIGN Act and UETA, systems that capture transactions must keep an associated record that reflects how the signature was created. Systems may also generate a graphic or textual statement that proves a transaction was executed with an electronic signature.

- Record retention: US laws require that e-signature records are retained and can be accurately reproduced by or for all required parties.

E-Signature Compliance Requirements by Industry

Some industries are legally required to protect confidential data and authenticate documents to prove they were signed and sent by a specific individual. As a result, organizations in particular industries have to use e-signature solutions to comply with legal regulations, including:

- Accountancy: Electronic signatures enable accountancy firms to remotely complete online tax returns and declarations, fulfill employee contracts and sign contractual agreements.

- Banking and Finance: Any financial service offering online banking must ensure transactions are secured by digitally signing legally binding transactions, such as opening a bank account, applying for a loan and securing a mortgage. Financial firms must also protect personal data like account numbers, passwords and PINs.

- E-Commerce: Authentication and security are crucial to completing and streamlining online transactions. Buyers’ locations could vary significantly from business to supplier, so electronic signatures make it easier to complete online contracts.

- E-Health: Electronic health data and personal information is protected by various regulations surrounding the processing, privacy and storage of sensitive data. E-signatures enable employees, patients, physicians and vendors to securely sign contracts and streamline health-related claims payouts.

- E-Invoicing: Electronic invoicing allows public sector organizations to receive and process contracts in line with relevant regulations. Using e-signatures helps businesses to guarantee the authenticity and integrity of the document.

- Government: Multiple levels of government rely on electronic signatures to secure processes and provision services. Public bodies can use the process to provision payments for services like housing agreements and waste, secure electronic applications, submit official government declarations, sign internal agreements and sign contractual agreements with third parties like builders, electricians and plumbers. E-signature solutions are also critical to providing identity services like electronic passports.

- Insurance: Insurance firms providing online services must provide rapid but streamlined renewal of contracts and coverage agreements. Electronic contracts contain sensitive data, so e-signatures keep this information secure, enable claims to be verified easily, simplify claims investigations and ensure customers can be held in breach of contract.

- Legal: Electronic signatures are vital for legal firms to fulfill agreements and contracts. It also helps firms keep on top of document revisions and prevent the rescinding of contractual evidence in the courtroom.

- Property and Real Estate: Property firms rely on the security of e-signatures to authenticate and validate processes like house contract agreements and registering transfer deeds.

- Retail: E-signatures are crucial to securing both online and in-store purchases, as well as agreements between employees, suppliers and vendors. Electronic document signing also helps secure card payments across the payment network between cardholders, card issuers, merchants and more.

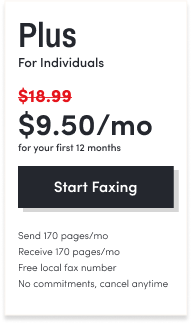

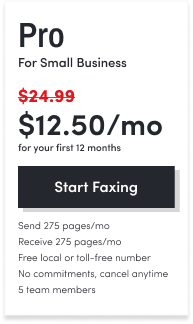

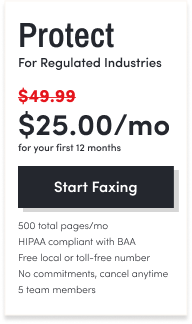

eFax: The Best Way to Sign Documents Electronically

eFax products, including Plus & Pro, Protect, and Corporate enable users to securely sign and share documents electronically from any device. This includes the eFax mobile app, which allows users to open a file, choose their signature and place it wherever they need to on the document. Android and iPhone users can also create an e-signature with eFax by photographing their physical signature or drawing it directly on their touchscreen. Another option is to use the eFax Messenger to sign a document electronically. In the app, users can create a signature by photographing a handwritten signature, drawing it with their finger or typing their name and selecting a preset font.

eFax’s electronic signature capability enables organizations to streamline their contractual processes and workflows. It’s ideal for companies with multiple offices in disparate locations worldwide, allowing people to collaborate on and sign documents simultaneously.

eFax also provides critical business solutions like online faxing, unlimited cloud storage and communication processes that comply with stringent regulations like the Health Insurance Portability and Accountability Act.

FAQ’s Around E-Signatures

An electronic signature is an online alternative to physically signing a document by hand. It enables people to digitally sign documents from any device anytime and anywhere.

Electronic signatures can be created by drawing a signature on a mobile device touchscreen, writing a signature on a stylus pad, uploading a photo of a handwritten signature, or typing a name and using a custom template.

Yes, a signature placed in a PDF is an electronic signature. Document owners can add their existing electronic signature into a PDF and invite contacts to countersign.

To sign a PDF, users must sign up for an e-signature solution like eFax and then upload their PDF document to the service. Users can then create fields for people to insert their initials, signature and date and then invite contracts to sign the document via email, online fax or other messaging solutions. Recipients can open the document, review the text and select their preferred electronic signature.

Examples of electronic signatures include lawyers and clients signing a legal contract, tenants and realtors signing a mortgage agreement and patients and doctors signing a medical agreement digitally.

Yes, e-signatures are legally binding and comply with regulations like the ESIGN Act and HIPAA.

Electronic signatures are verified by security processes like the Public Key Infrastructure, which encrypt and decrypt documents, and digital certificates that verify the owner of a key.