Customers & Business

How to Securely Fax Insurance Documents Online

Faxing insurance documents remains highly relevant in the modern business world despite the rise of digital communication. Many insurance companies require documents to be sent via fax for security and compliance reasons, as there’s less risk of data being intercepted or stolen than through digital tools like email.

Whether you need to file a claim or apply for a new policy, it’s crucial to understand how to securely send insurance documents by fax. Read on to discover how to fax insurance documents and the information you may need to fax to insurance company.

Why Faxing Insurance Documents is Still Important

Insurance claims contain sensitive personal information that malicious actors could use to launch cyber attacks. So it’s vital to keep this data safe from prying eyes and prevent unauthorized access.

Fax messages are transmitted via phone lines rather than across the Internet. Online faxing services like eFax also use tools like Advanced Encryption Standard (AES) and Transport Layer Security (TLS) encryption to protect critical insurance documents. This ensures unauthorized users can’t open or read a fax message even if they manage to intercept it.

Key Scenarios for Sending Insurance Documents via Fax

There are various scenarios in which you may need to send a fax to an insurance company. A few common use cases include:

- Filing an insurance claim: One of the most common scenarios in which you may need to send insurance documents by fax is to file an insurance claim. Insurance claims, in the event of a personal injury or a vehicle accident or to submit a life insurance claim, often contain sensitive personal information, such as your name, address, date of birth, email address and financial details. It’s vital to keep this data safe by faxing your claim to your insurance company.

- Updating or canceling a policy: Updating or canceling an existing insurance policy requires you to advise the insurance company of the change. The process involves submitting sensitive information, such as your policy number, payment and banking information and personal information. So insurance companies may require you to fax your policy updates or changes.

- Sending proof of identity or medical records: Insurance companies may require you to verify a claim or policy. For example, you may need to send proof of your identity with a home insurance claim or submit medical records to an insurance firm. The verification process may require you to submit highly sensitive information, so it’s critical to keep this data secure via online fax messaging.

Fax Numbers of Major Insurance Companies

Before you send insurance documents by fax, it’s vital to ensure you’re submitting the message to the correct fax number. Insurance companies that require you to fax a claim or policy to them will list their fax numbers on their websites on the application form. Here are fax numbers for a few major US insurance companies:

Lincoln Financial: 1-877-843-3950

Mass Mutual: 1-413-226-4054

MetLife: 1-908-655-9586

New York Life: 1-908-840-3043

Northwestern Mutual: 1-414-665-4268

Prudential: 1-855-308-4434

4 Simple Steps To Fax Insurance Documents Online

Online faxing solution eFax makes it easy to share your fax insurance documents with your insurance company. Follow these steps to sharing insurance documents online:

Sign Up For eFax

The first step to send insurance documents by fax is to register for the eFax online faxing service. Visit the eFax homepage, click Sign Up, complete the quick registration process and then install and open the eFax messenger or log in to the website.

Create Your Fax Message

Start crafting your first online fax message by tapping the pencil symbol. You can then write a message, attach your insurance claim or policy documents and enter the insurance company’s fax number in the recipient field.

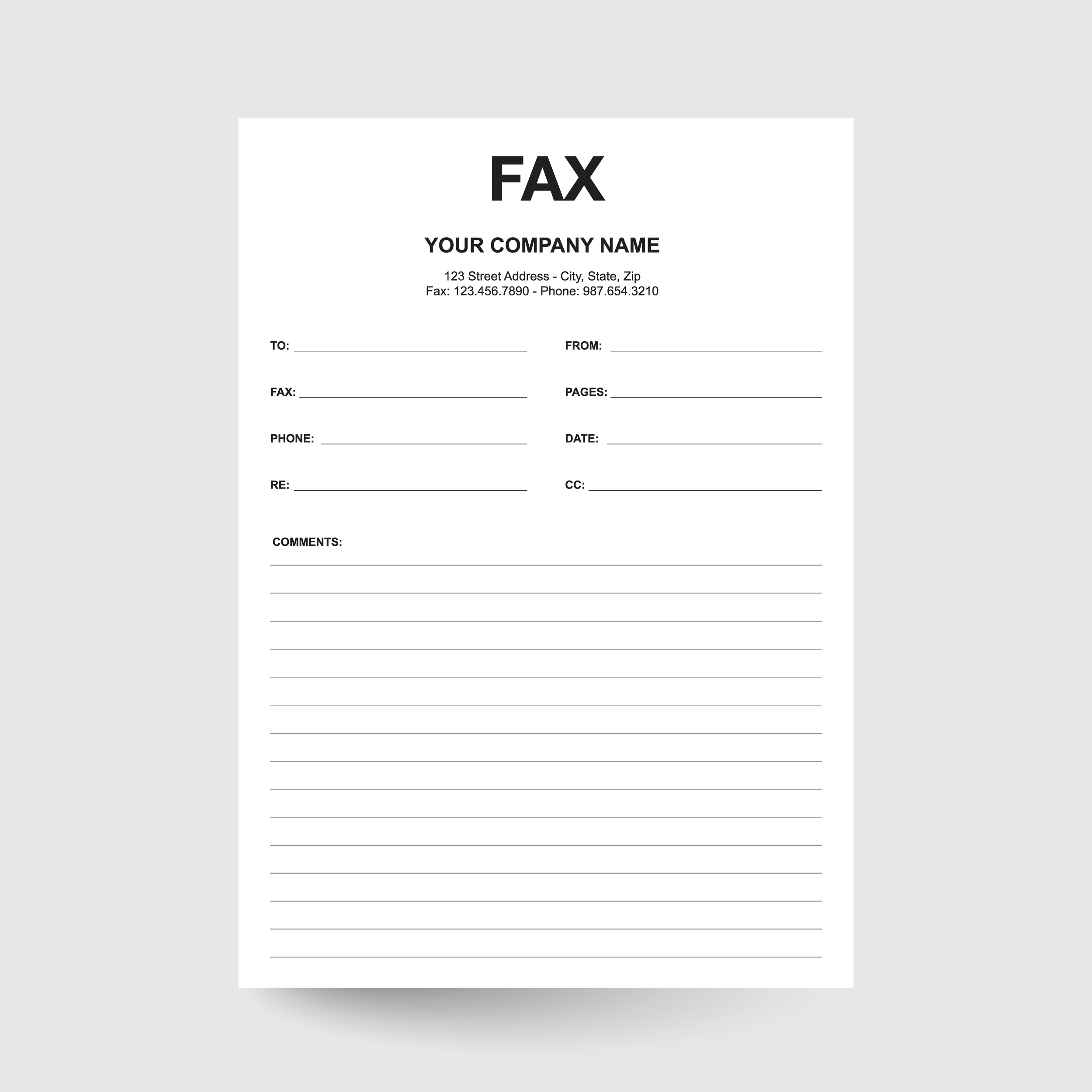

Create A Cover Page

With the fax message created, a critical next step is to add a cover page, which provides an overview of the document you’re sending. The cover page should contain information like your name and contact details, the recipient’s name and contact details, the number of pages included, the time and date and a short summary of the fax contents.

Send Your Fax

Hit the ‘Submit’ button to send your fax to your insurance company. eFax will confirm that the fax has successfully reached the recipient.

You can fax your insurance documents easily from a variety of devices and mediums. Our comprehensive guide on how to fax online will walk you through the different methods, whether you’re using a laptop, smartphone, or tablet. Start faxing securely and efficiently, and gain the confidence to manage all your faxing needs without any hassle.

3 Security Tips for Faxing Documents to an Insurance Company

Security is a critical consideration in how to fax insurance documents to your insurance provider. eFax helps you protect sensitive data, but you can further guarantee security by following these tips:

Use Encryption

Encrypting data is critical to protecting sensitive information and preventing cyber attacks. It may even be a regulatory requirement to ensure that sent and received faxes are secured through encryption.

Secure Received Fax Communication

It may be easy to think you only need to worry about protecting the fax messages you send to your insurance company. However, it’s also vital to have technology in place to safeguard received fax messages and securely store faxes for auditing and compliance purposes.

Protect Physical Fax Machines

If your company utilizes physical fax machines, they can make you vulnerable to hacking, especially if they’re connected to the Internet. Fax machines may have weak security protocols or lax authentication protocols, making them easy targets for hackers. So, if your organization relies on fax machines, ensure they’re constantly updated and limit their network access.

eFax: The Most Secure Way to Fax Insurance Documents Online

eFax’s secure online faxing service makes it easy to fax your insurance claims and policies at any time, from anywhere and on any device. The benefits of eFax include:

Secure Faxing: eFax secures your fax messages through 256-bit AES and TLS, the highest encryption standards. The technology encrypts sent and received faxes on user devices and while in transit using AES 256-bit and TLS encryption.

Regulatory Compliance: eFax helps you maintain robust auditing and reporting, bringing fax processes in line with data privacy and compliance requirements like the California Consumer Privacy Act (CCPA), the Health Insurance Portability, HIPAA and the European Union’s General Data Protection Regulation (GDPR).

Cost Saving: eFax helps you reduce costs by removing the need to buy and maintain fax machines, purchase phone lines, and stock up on office supplies like paper, ink and toner.

Secure Cloud Storage: eFax provides unlimited cloud storage to help you keep all users’ sent and received messages in the secure eFax cloud environment. Fax messages are accessible at any time on any device, removing concerns about critical documents being lost or deleted.

Tech Integration: eFax is compatible with your employees’ favorite business applications and workflows, making it easy to integrate with your existing infrastructure. Employees can access eFax through email and social media services, collaboration tools and cloud storage solutions.

FAQs Around Faxing Insurance Documents

If you’re researching how to fax insurance documents, online faxing solutions enable you to send insurance documents by fax without a physical fax machine. Online faxing solutions like eFax allow you to securely submit insurance claims and policies at any time, from anywhere and on any device.

When you send insurance documents by fax, your insurance company receives the message immediately. eFax’s online faxing service sends you a receipt confirmation when the insurance company receives your fax.

Yes, online faxing is a highly secure way to send insurance documents.

If you need to send a fax to insurance company, you can find their fax number listed on their website or on the application form you complete.

Yes, eFax enables you to attach up to ten documents to a single fax message when you send a fax to insurance company.